Commentary Contributed by Saurabh Shelar, Research Analyst at MarketsandMarkets

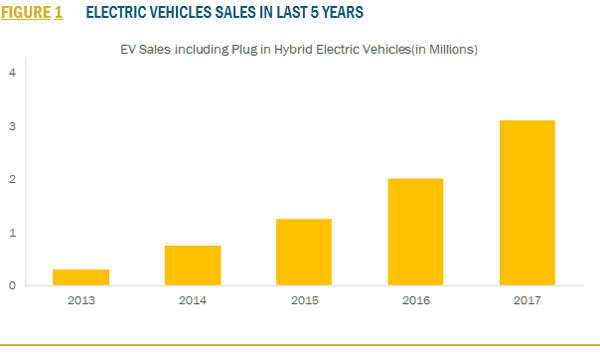

July 25, 2018 | Lithium-ion battery is the fastest growing battery industry globally primarily due to the increasing acceptance of Electric Vehicles (EVs). The surge in the demand for EV can be attributed to policies drafted by various countries to achieve the environmental objectives such as reducing the emission of carbon, and controlling the rising temperature globally.

EV is an automobile which doesn’t require fossil to run, which means it doesn’t require an internal combustion engine (ICE). Unlike the conventional automobile an EV has a battery-operated power train. There are three prominent rechargeable battery technologies that can be used in the power train of EV; lead-acid, nickel secondary batteries, and lithium-ion battery. Amongst these batteries, lithium-ion battery is considered the most suitable type of battery for EV, as they can provide performance close to that of the fossil fuel driven conventional vehicles. Lithium-ion battery are generally found in the prismatic, cylindrical, and polymer type construction. Each of the above-mentioned battery follows a different cell construction and is used for different application.

Since EV is battery operated, they do not have an internal combustion engine (ICE) making it more spacious compared with a conventional vehicle. Further to increase the attractiveness of EV to the buyer, government in various countries are providing monetary and non-monetary incentives. Some of the examples for monetary incentives includes tax exemptions, waiver of parking, charging, and toll fees. Non-monetary incentives include access to bus lines and access to high occupancy vehicle (HOV) lane.

Growth in Electric Vehicles resulting in investments in Lithium Ion Batteries Market

Attractive opportunities in the lithium-ion battery market have resulted in capacity expansions by the leading battery manufacturers. For instance, Samsung SDI and LG Chem have new manufacturing facilities coming in Europe. Leading automobile manufacturer Honda is investing in new battery manufacturing plant in India. Sustainable energy development has been another major factor for the growth of the lithium-ion battery. It has been observed that batteries can help power the developing nations remote villages with energy without putting a power plant by harnessing the renewable energy. According to Elon Musk, CEO Tesla, the world needs 100 gigafactories to power the whole world towards sustainability. At present the leading EV manufacturers don’t manufacture their own batteries, for e.g. Samsung SDI supplies lithium-ion batteries to BMW and LG Chem supplies to GM. With large automobile company establishing their own battery plants the transition towards the sustainable transport can be achieved quickly. Government policies can also help in accelerating the growth of the market and enhance the attractiveness of EV’s and renewable energy harnessing for clean energy generation.

Innovations in Cathode Materials critical to growth of Electric Vehicles

Battery is the major cost contributor to EV, currently batteries constitute around 50% of the total EV cost. Battery cost can be further broken down into cathode materials, anode materials, electrolytes, separators, casing, and labour cost. Amongst these materials, cathode contributes an average of 26% of the total battery cost, which has led to tremendous research in the cathode components of battery. Cathode is the positive electrode that accepts electron during discharge. Leading manufacturers of cathode materials for lithium-ion battery includes Umicore, BASF, and Johnson Matthey among others.

The cathode materials in the lithium-ion batteries have better electrochemical performance parameters than the cathode materials in the lead-acid batteries, nickel–cadmium batteries, and nickel metal hydride batteries. Owing to its characteristics such as high power, high efficiency, low self-discharge, and long lifetime, the lithium-ion cathode materials are used in the energy storage technologies. Various players in the market are working toward improving the performance of the lithium-ion battery cathode materials, which makes them attractive options for the stationary energy storage applications.

There are various types of lithium-ion battery chemistry based upon the type of cathode material. Commonly used cathode materials are lithium iron phosphate (LFP), lithium cobalt oxide (LCO), lithium nickel cobalt aluminum oxide (NCA), lithium nickel manganese cobalt oxide (NMC), and lithium-ion manganese oxide (LMO) amongst others. Lithium polymer pouch battery uses aluminum foil as the cathode current collector and LCO as the positive active material. Prismatic cells generally have LMO/NMC as their cathode material and are used in various applications ranging from EVs to portable devices.

Each cathode material can be classified based on 6 parameters namely specific energy, specific power, safety, cost, life span, operating temperature, and performance. Improvement in these parameters can be achieved by various means, for e.g. specific energy can be improved by increasing the content of cobalt. Energy density can also be improved by increasing the content of nickel. Cost can be reduced by reducing the content of cobalt and increasing the content nickel.

Lithium prices have seen growth during the last two years on the back of high demand and weak supply. However, this is expected to change next year with capacity additions of around 500,000 tons coming in Chile. Nickel has witnessed drop in the prices between 2013 and present, with prices coming down from USD 8 per pound to USD 6.5 per pound in June 2018. The major cost contributor to the cathode is cobalt. Over 50 percent of the global cobalt supply is shipped from Democratic Republic of Congo. Cobalt prices have surged drastically between 2016 to present. In June 2016, one kilogram of cobalt was trading around USD 28, which is currently trading at over USD 75 per kg. This has resulted in reduced consumption of cobalt in the EV battery, for instance between 2009 and 2018 Tesla has reduced the cobalt content in its batteries by over 55 percent of the total battery weight.

To make EV affordable one must reduce the cost of the battery. This has resulted in several leading EV manufacturers to tweak the composition of their battery to find a cost competitive alternative to battery and to make it comparable to the conventional automobiles.

Amongst the battery chemistry mentioned above LCO, NMC, and NCA batteries contain cobalt as a cathode active material. LCO consumes maximum amount of cobalt by weight (around 60 percent). LCO batteries are most preferred batteries for handheld and portable electronics due to its high specific energy and long run time. NCA battery uses around 10 percent cobalt. NMC is a chemistry of cathode material which has best overall performance parameters and allows for tweaking the content of cobalt in them. At present several combinations of NMC are being researched upon. These includes 8:1:1, 6:2:2, 4:3:3, 5:3:2, 4:4:2 etc. NMC 1:1:1 composition is the commercialized technology, however SK Innovation and LG Chem are expected to start the production of 8:1:1 NMC cathode by the end of 2018. 8:1:1 NMC demonstrates a similar performance to the traditional NCA battery which has 80 percent nickel content. Tesla has partnered with Dalhousie University to develop next generation cost effective NMC cathode material. Such measures would encourage other leading battery manufacturers to conduct similar research partnership programs to enhance their battery performance.

On a whole next decade would be inspired with significant improvements in battery parameters and drop in the cost supported by government policies and technological enhancements in various battery parameters such as cathode materials. The growth of Li-ion cathode materials market is expected to be higher as compared to other battery types. The overall cathode materials market is thus projected to grow owing to the increasing demand for automobiles, portable devices, and energy storage systems (ESS) according to a Report from a Research firm MarketsandMarkets.